Trade Review and Tips for Trading the Euro

The price test at 1.0582 occurred as the MACD indicator began moving downward from the zero line, confirming the correct entry point to sell the euro. As a result, the pair dropped to the target level of 1.0540, generating a gain of approximately 40 points. Later today, we will hear from several FOMC members, including Michael S. Barr, Michelle Bowman, and Lisa D. Cook. Their statements may influence the US dollar. If they signal a more cautious approach to monetary easing, the dollar could strengthen further against the euro. Fed policy changes often trigger reactions from other central banks and influence international investments. For traders and economists, closely monitoring these remarks is crucial. For today's intraday strategy, I will focus on implementing Scenarios #1 and #2.

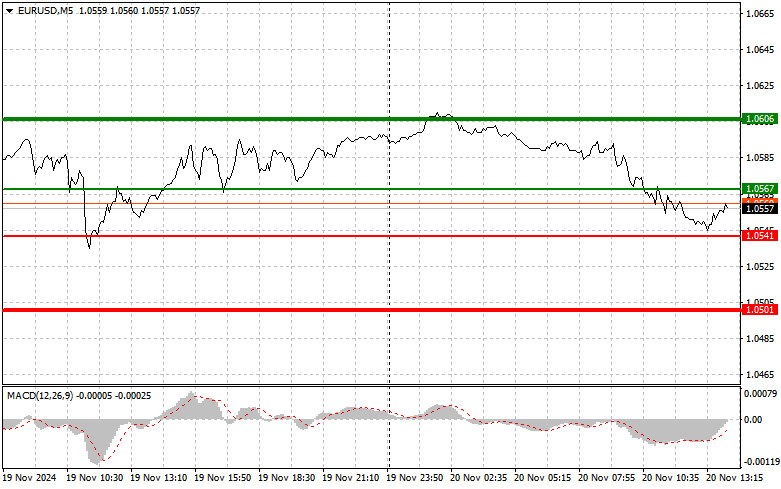

Scenario #1:Buy the euro at 1.0567 (green line on the chart), aiming for a rise to 1.0606. At 1.0606, close the position and consider selling the euro in the opposite direction, targeting a 30-35 point move downward. A strong euro rally is unlikely today unless dovish comments from the Fed are made, which seems improbable.Important: Ensure the MACD indicator is above the zero line and beginning to rise before buying.

Scenario #2:Buy the euro if the price tests 1.0541 twice and the MACD indicator is in the oversold area. This setup would limit the pair's downward potential and lead to a market reversal. The targets would be 1.0567 and 1.0606.

Scenario #1:Sell the euro at 1.0541 (red line on the chart), targeting a decline to 1.0501. Close the position at 1.0501 and consider buying back, expecting a 20-25 point rebound. If Fed members take a hawkish stance, pressure on the pair will intensify.Important: Ensure the MACD indicator is below the zero line and beginning to decline before selling.

Scenario #2:Sell the euro if the price tests 1.0567 twice while the MACD indicator is in the overbought area. This setup would limit the pair's upward potential and trigger a market reversal downward. The targets would be 1.0541 and 1.0501.

Chart Explanation

Important Note:Beginner Forex traders should exercise caution when entering the market. It is best to stay out of the market before significant fundamental reports to avoid sharp price fluctuations. If trading during news events, always use stop orders to minimize losses. Without stop orders, you risk losing your entire deposit, especially when trading large volumes without proper money management. Remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous decisions based on market conditions often lead to losses for intraday traders.