Evropské trhy budou ve čtvrtek otevírat opatrně a hlavní burzy otevřou téměř beze změny, protože investoři očekávají oznámení o měnové politice Bank of England, Švýcarské národní banky a švédské Riksbank.

Příliv evropské aktivity přichází poté, co americký Federální rezervní systém ve středu ponechal své klíčové sazby na stejné úrovni a zároveň naznačil, že snížení o dva čtvrt procentní body je pravděpodobné ještě letos, a to navzdory nejistotě, kterou představuje obchodní politika amerického prezidenta Donalda Trumpa.

Trumpova volatilní celní oznámení a hrozby budou zvažovat také světové centrální banky z hlediska jejich potenciálního dopadu na globální růst, inflaci a měnové trhy.

Všeobecně se očekává, že Bank of England na svém březnovém zasedání navzdory slabému hospodářskému růstu sazby ponechá, zatímco tržní ceny naznačují možné snížení sazeb ve Švýcarsku – poté, co tamní meziroční míra inflace v únoru klesla na pouhých 0,3 %. Riksbank je považována za banku, která sazby ponechává na stejné úrovni.

Regionální index Stoxx 600 uzavřel poslední čtyři seance výše a odrazil se od ztráty 1,22 % z minulého týdne.

Německý DAX ve středu přerušil vítěznou sérii, když se zdálo, že investoři „kupují fámy, prodávají fakta“ poté, co zákonodárci odhlasovali povolení výjimek z dluhových pravidel, čímž uvolnili stovky miliard na výdaje na obranu, infrastrukturu a klima. Potenciál této reformy byl dosud hnacím motorem silných zisků německých průmyslových, výrobních a obranných firem v tomto měsíci.

Trade wars matter more than politics. Friedrich Merz's proposal to revise Germany's fiscal brake rule laid the foundation for EUR/USD's upward trend. Theoretically, his failure to become chancellor should have triggered profit-taking on long positions. The Christian Democratic Union leader failed to secure the required 316 votes, even though his coalition, on paper, held 328 out of 630 Bundestag seats. Nonetheless, the euro held its ground, aided by the unfolding trade wars.

According to a Bloomberg insider, the European Union is preparing a Plan B. If trade talks between Brussels and Washington collapse, the EU is set to impose retaliatory tariffs on US imports worth €100 billion. A draft of the potential countermeasures will be handed over to EU member states by May 9, with discussions expected to continue for a month. Donald Trump's 90-day delay seems to have given his opponents time to prepare a counterstrike.

The EU estimates that €549 billion of European exports are subject to US tariffs. The EU runs a trade surplus with the US in goods and a deficit in services. Targeting US service exports could pose serious problems for Washington.

What's more, China is urging Europe to join forces in resisting unilateral intervention and defending fairness and justice. A trade war on two fronts against such powerful adversaries would come at a high cost for the US and the dollar. A breakdown in confidence toward the greenback was the catalyst for EUR/USD's April rally. The only player capable of restoring that trust is the Federal Reserve. The hope that Jerome Powell and his colleagues will act to that end prevents the bulls from regaining complete control.

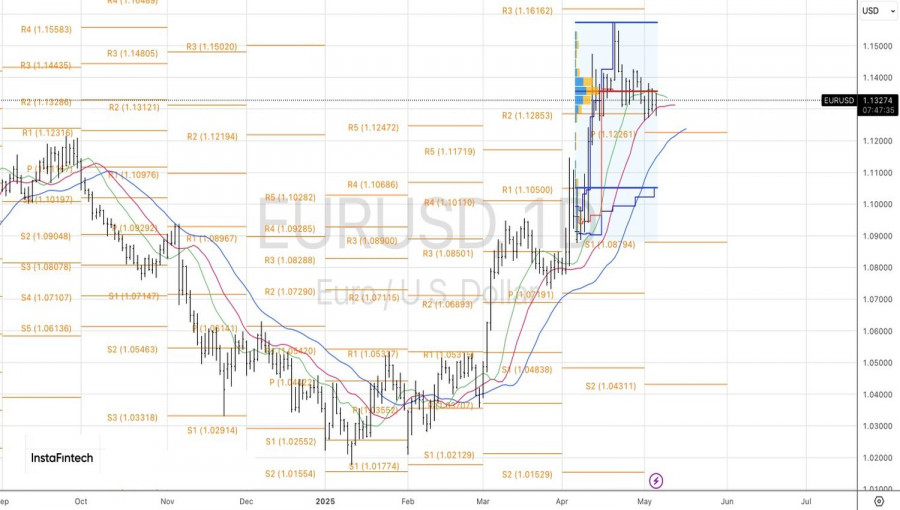

The battle between bulls and bears is being fought over every inch of ground, resulting in a consolidation of the main currency pair within the 1.128–1.138 range. Only a breakout from this range will determine the next directional move for EUR/USD.

Curiously, to restore faith in the dollar, the Fed needs only to resist Trump's pressure and refrain from cutting rates in May or June. The futures market reflects this sentiment: the probability of a rate cut at the June FOMC meeting has dropped from 65% at the end of April to just 27%.

Unsurprisingly, Trump will likely be unhappy with any Fed verdict and will once again direct a flood of criticism at Powell. However, the central bank's independence remains unquestioned for now, allowing the Fed Chair to continue ignoring jabs from the 47th President of the United States. The key is not to rise to provocation.

On the daily chart, EUR/USD remains in a consolidation phase within a "Spike and Ledge" pattern. A breakout above the fair value level at 1.1355 would increase the likelihood of a move toward the upper boundary of the 1.1280–1.1380 range and could justify initiating or expanding long positions in the pair.