September is traditionally an unfavorable month for US equities, with the S&P 500 historically falling by an average of 2%.

Current sell-offs in the bond market are putting pressure on the stock index, despite differing opinions on the reasons behind this behavior.

Analysts warn that the index's resilience in the coming weeks will depend on macroeconomic data.

Follow the link for details.

Nvidia shares fell below the 50-day moving average for the first time since May, raising concerns among investors.

Despite the current correction, the company remains a leader in the AI sector with growth potential.

Additional pressure on the stock comes from expectations of competitors' earnings reports.

Follow the link for details.

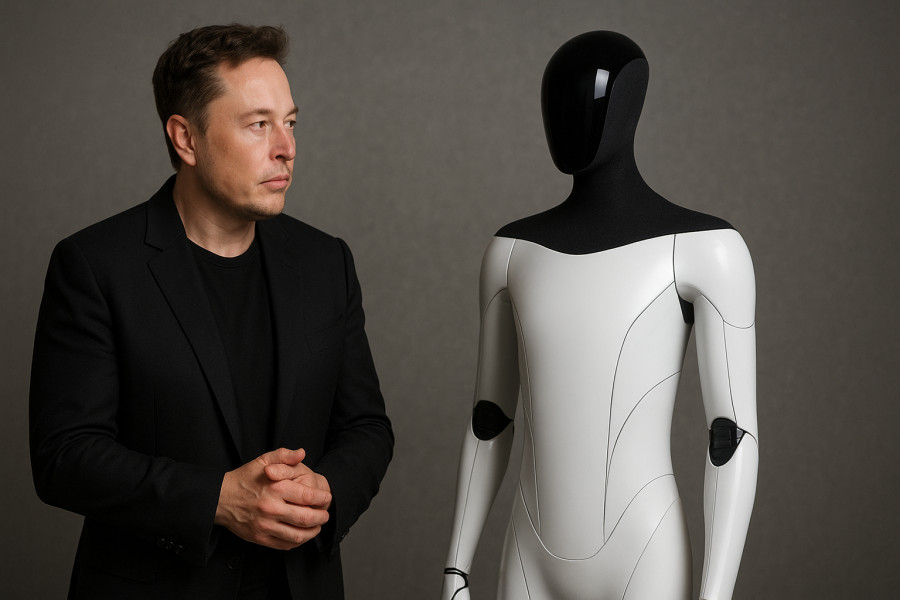

Elon Musk is shifting Tesla's focus toward robotics development, which he believes will determine the company's future capitalization, replacing electric vehicles.

This strategy carries risks but also creates opportunities for speculative trading.

Experts note that the success of the project could radically change Tesla's business structure.

Follow the link for details.

OpenAI announced the acquisition of startup Statsig for $1.1 billion, strengthening its position in AI and expanding its technology ecosystem.

The deal carries potential benefits for Microsoft, another major player in the sector.

Analysts believe that the acquisition will accelerate the development of new products and services.

Follow the link for details.

Let us remind you that InstaForex offers the best conditions for trading stocks, indices, and derivatives, helping traders earn effectively on market fluctuations.